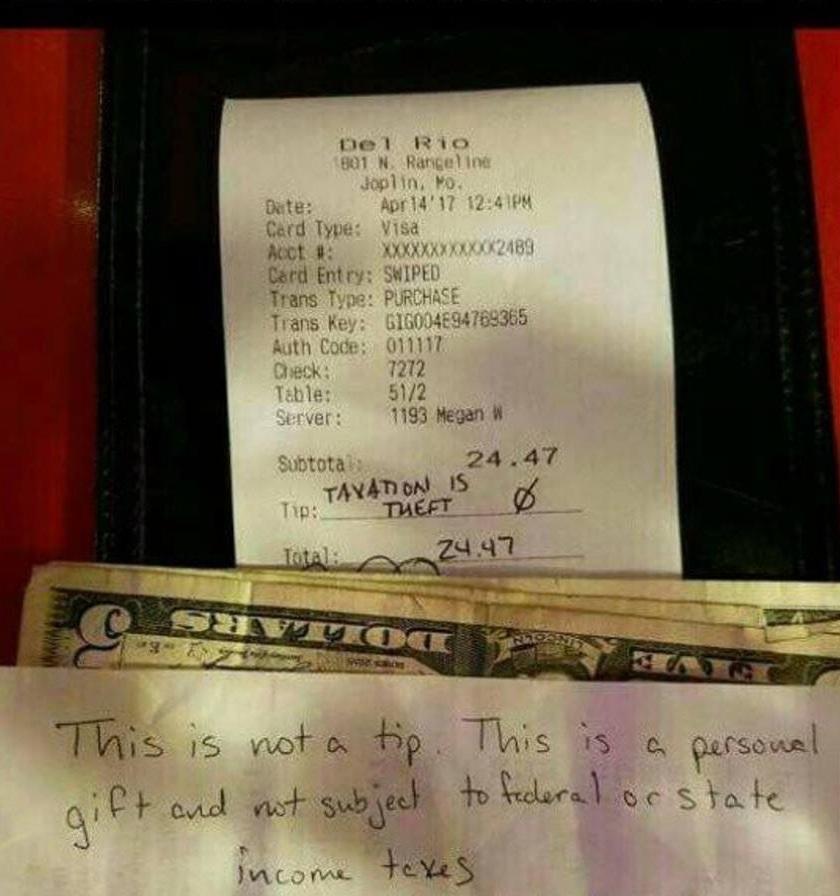

Instead of tipping their waitress, this customer left a pile of cash and a note. But what she decides to do about it could be illegal.

Anyone who has worked in the service industry as a tipped wage server or a minimum wage worker, knows that both struggle to make ends meet.

But if this waitress follows her customer's advice, she might be breaking the law.

In the United States, the minimum wage for tipped workers is $2.13 per hour. If they don't make what they'd earn under the federal minimum wage, the employer must make up the difference at the end of the week.

According to the Internal Revenue Service (IRS), refusal to claim tips for tax purposes is illegal. Doing so could put you at risk of being audited.

Although the IRS "Tips on Tips" guide does specify that "income received from the form of tips is taxable," there is nothing clear about what to do if the money is given as a 'gift.'

Gifts of money are taxable, but only if they exceed $13,000.

What do you think she should do?

[h/t ATTN:]